On 8 November 2024, we joined the many voices advocating prioritizing a solution to the exchange rate challenges. Our primary concern is to ensure that the impact on members, including European investors, is heard.

It is also of the utmost importance that international suppliers of goods and services and foreign investors have confidence that payments will be received and/ or interest, dividends, and capital gains can be repatriated to their own countries.

We also offer our recommendations on low hanging fruit for Government’s immediate attention.

The Situation

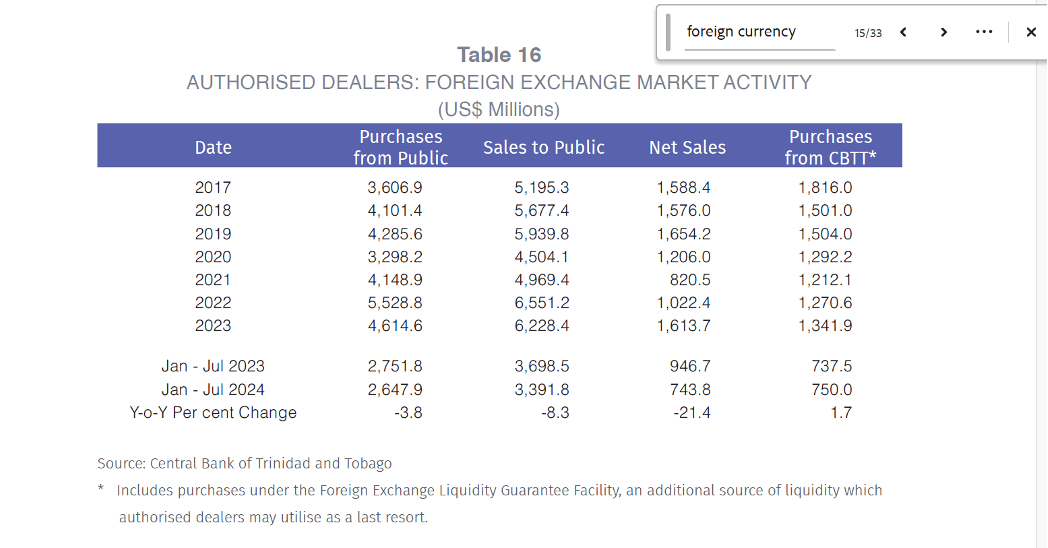

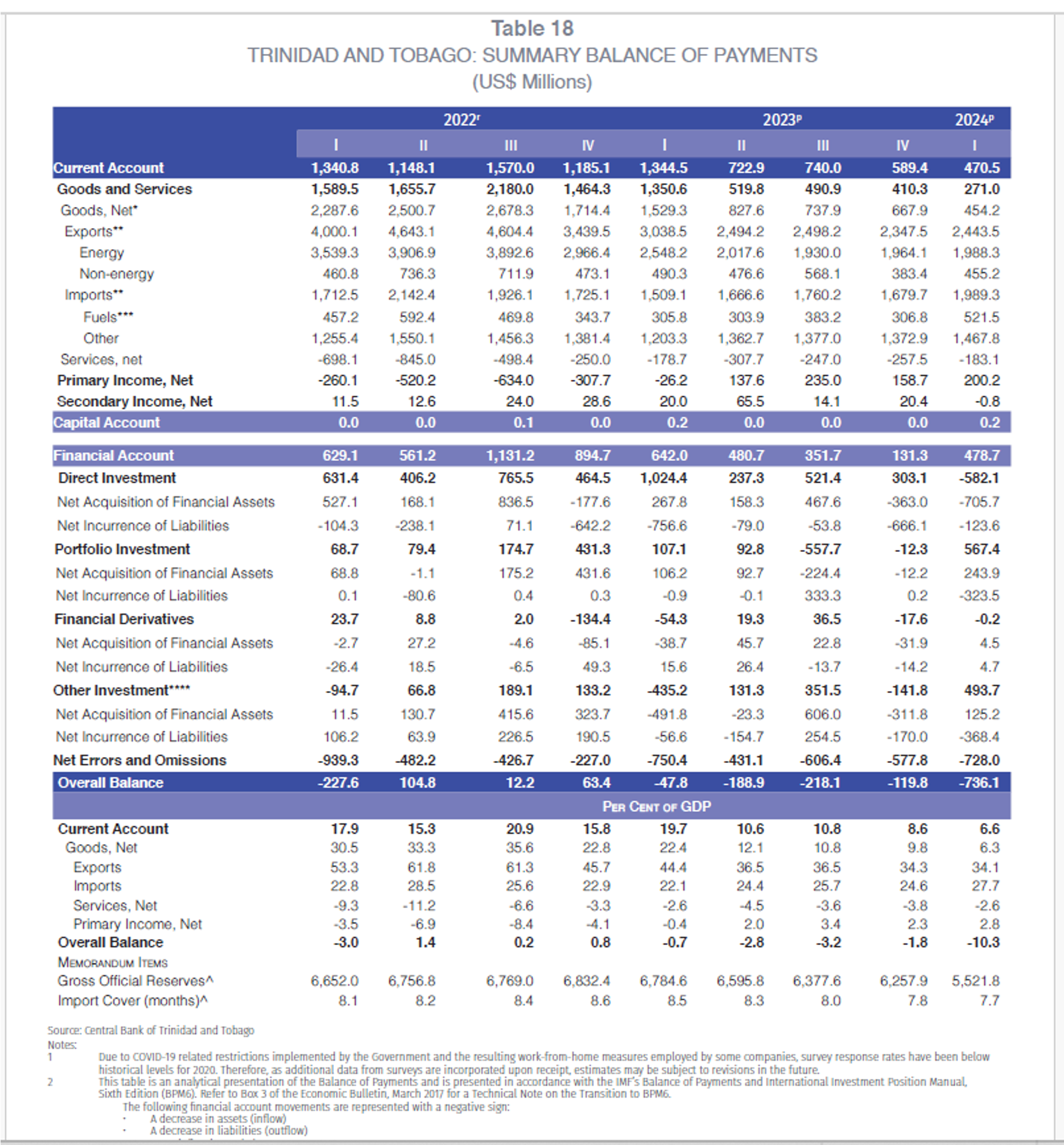

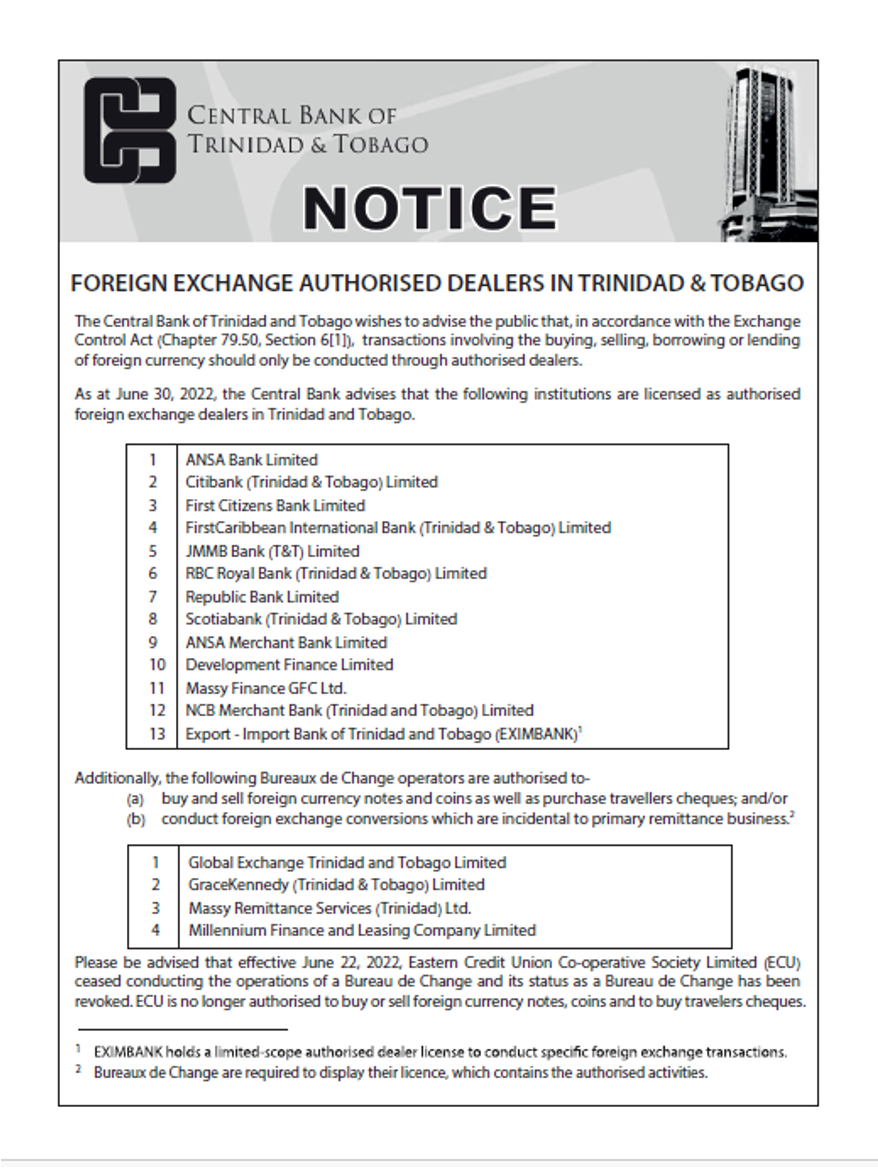

According to Central Bank statistics, sales of foreign exchange from authorized dealers (banks, other financial institutions, bureaux de change- see the list on the last page) to the public (demand) outweigh purchases of foreign exchange (supply) from the public by authorized dealers. This leads to the Central Bank having to release foreign currency reserves to supplement the shortfalls within the authorized dealers’ systems. The table above shows that this has been ongoing since 2017 or before.

Prolonged deficits put the level of reserves and import cover at significant risk.

According to the Central Bank Economic Bulletin, in July 2024, the country has 8.1 months of import cover.

The shortfall in foreign exchange is due mainly to declining export earnings (primarily in the energy sector) and declining direct investment, contributing to less forex circulation in official channels.

Impact

Authorized dealers, and particularly Banks, have been exercising controls through daily credit card limits, limits on transfers, and limits on the sale of forex. There have been many complaints about the level of controls and the lack of transparency regarding allocation and prioritization in response to demand.

The result of the above is that importers cannot purchase sufficient forex promptly, international suppliers are not paid promptly, and foreign companies cannot repatriate their funds promptly.

It should be noted that the governing legislation does not legally control or limit the repatriation of capital, dividends, and interest, but the deficits are leading to controls and difficulties in accessing currency, even from USD accounts held in Trinidad and Tobago.

Companies and individuals that collect foreign currency prefer to maintain their accounts outside of Trinidad and Tobago, and those with foreign currency accounts in Trinidad and Tobago are hoarding forex, resulting in reduced levels sold to authorized dealers and a build-up of private forex holdings.

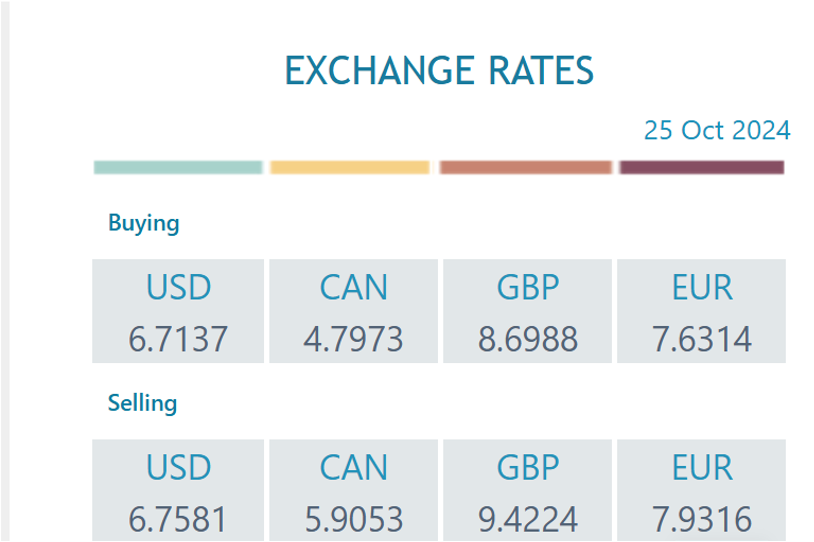

The black market is also thriving and quite open, and it is common to see importers indicate a willingness to pay 7, 7.3, or even higher versus 6.75, which is what the Banks may offer.

On May 8, 2024, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Trinidad and Tobago. IMF Executive Board Concludes 2024 Article IV Consultation with Trinidad and Tobago. They encouraged the authorities ‘to remain vigilant and stand ready to increase the monetary policy rate should potential capital outflow risks intensify. Directors stressed that addressing foreign exchange (FX) shortages remains a priority and encouraged adopting a more efficient market-clearing infrastructure for allocating FX. They noted that removing all restrictions on current international transactions and greater exchange rate flexibility over the medium term would help meet the demand for FX.

Possible solutions and Recommendations

EUROCHAMTT believes there are low-hanging fruit to be considered:

1. There is a need to emphasize tourism promotion and allow all tourism facilities to be collection points for foreign exchange.

2. Increasing the supply of natural gas and LNG for export to meet current demand in Europe by prioritizing projects in the pipeline (Dragon gas fields) and prioritizing the necessary policy and legislation for renewable energy for domestic energy demand.

3. Improvement in the investment environment to attract and retain investors. This includes:

a. full implementation of all international tax governance, anti-money laundering, and anti-fraud-related legislation and regulations impacting the country’s reputation and risk ratings and

b. passing necessary legislation that helps the country comply with international agreements such as those in the fisheries bill.

On tax governance, full compliance will remove the risks for European investors of facing penalties imposed by their own governments for operating in non-compliant or non-cooperative jurisdictions for tax purposes.

In the case of fisheries, once the fisheries bill which addresses illegal, unreported, unregulated fishing and promotes sustainable fisheries management is passed, there is potential for new markets for fish exports to open especially in Europe. There will also be interest in supporting investment and upgrade of fisheries infrastructure around both islands, creating multiplier effects.

4. Improvement in all the investment procedures to ensure well-documented, transparent, and time-bound procedures that work without state facilitation.

5. Ensuring a much more friendly and customer-oriented service to investors. This pertains especially to procedures for work permits and residency applications managed by the relevant divisions of the Ministry of National Security.

6. Addressing the limits in the Foreign Investment Act on investments in shares and real estate without a license for Trinidad and the even more significant restrictions for Tobago on foreign investment.